The Fallacy of Blaming the Market as the Sole Cause of High Gas Prices

In his May 3, 2012 column, Robert Samuelson claims “We should exorcise the politically convenient notion that high oil prices result from the market maneuvers of greedy “speculators.” But it’s hard to do that without ignoring the facts.

In an effort to disprove the role that speculation is playing in driving gas prices, Mr. Samuelson points to the following recent testimony before the Senate Energy and Natural Resources Committee by Howard Gruenspecht, acting administrator of the nonpartisan U.S. Energy Information Administration:

“The increases in crude oil prices since the beginning of 2011 appear to be related to a tightening world supply-demand balance and concerns over geopolitical issues that have impacted, or have the potential to impact, supply flows from the Middle East and North Africa.”

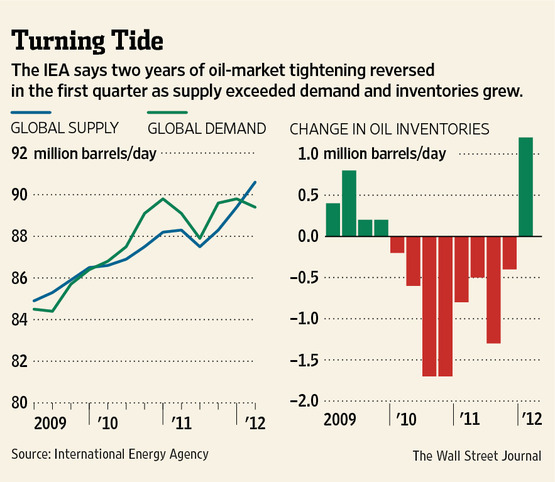

But just two weeks after that hearing, the Wall Street Journal reported in an article entitled “Pressure on Oil Supply Eases” that “two years of oil market tightening reversed in the first quarter as supply exceeded demand and inventories grew.” In fact, the tightening supply/demand balance had already reversed by the beginning of 2012. As the article reported “Global oil inventories grew by as much as 1.2 million barrels a day in the first quarter.” The most recent EIA National Defense Authorization Act report also confirms that a number of countries were actually producing at above average rates in the first quarter, including the U.S. Canada, Brazil, China, and Columbia substantially offsetting unplanned global production outages and reductions in exports from Iran.

When demand is declining and supply is increasing, it is textbook economics that prices are supposed to come down.

But that’s not what happened. As the graph accompanying the Wall Street Journal article makes clear, in the 1st quarter of 2012, the price of oil skyrocketed by more than 20 percent. And this occurred despite the fact that the supply/demand balance was actually loosening, not tightening. Clearly, more was at work in oil markets at the beginning of the year than supply and demand alone.

Mr. Samuelson also attributes higher gas prices to “shrinking spare capacity” and cites the testimony of another witness at the hearing, Dr. Daniel Yergin, chairman of the consulting firm IHS CERA. Here again, the facts are at odds with the testimony.

Just days before the hearing, Saudi Arabia announced plans to increase spare capacity by 2.5 million barrels per day – at least doubling the estimate of 1.8 to 2.5 million barrels per day of spare capacity Dr. Yergin had provided in his testimony.

Mr. Samuelson does acknowledge that “outside investors (a.k.a. “speculators”) have dramatically shifted money into commodities — raw materials” and that “Commodity index funds,” which invest in a basket of commodities (oil, wheat, corn), have attracted hundreds of billions of dollars.

But he doesn’t seem to appreciate how fundamentally this has changed the commodities markets. Four years ago, speculative traders held less than half of the futures contracts for crude oil. Today, according to the Chairman of the Commodities Futures Trading Commission, these traders now account for 85% of the crude oil futures market.

Because of this fundamental change in the commodities market, industry experts from the CEO of Exxon Mobil to Goldman-Sachs, the firm that practically invented the commodity index fund, have estimated the impact on oil markets from speculation at upwards of $20 a barrel, which translates to more than 50 cents a gallon at the pump.

Delta’s recent announcement that it is buying an oil refinery in Pennsylvania to protect itself against the risks of price spikes and potential fuel shortages is further evidence that the crude oil commodity market is no longer filling its traditional role of hedging risks for commodity users.

Certainly, speculation is not the only cause of high oil and gasoline prices. As Mr. Samuelson correctly points out, our dependence on a global market for oil is clearly a major factor. But it is far from the only factor driving up current prices at the pump. If speculation were not an issue, Mr. Samuelson’s prescription of “Use less, and produce more” should already have lowered prices significantly. Because that’s what occurred during the first quarter of 2012 and prices still soared to the highest level ever for that time of the year.

Courtesy of The Wall Street Journal: